The biggest news for the end of 2017 (and the start of 2018) has and still is the new TRAIN Bill. Passed last November 28, 2017, the bill affects everything from personal income, sweetened beverages, fuel, and estate. What does it mean for business owners though?

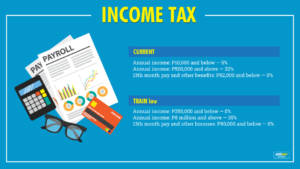

Based on the new bill, income earners and self-employed individuals with annual taxable income below P250, 000 are exempted from taxes. They are also no longer required to file income tax returns (ITRs).

For businesses with annual gross sales above P250, 000 but below P3 million, they can choose to use a flat tax of 8 percent, though they still have the option to use the schedular personal income tax rates.

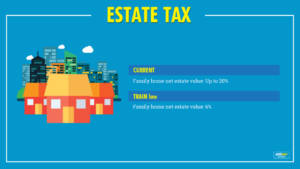

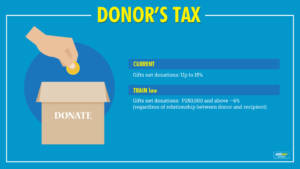

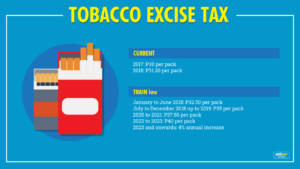

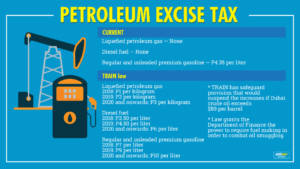

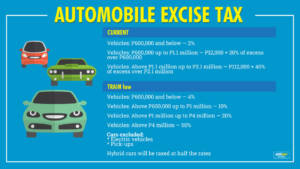

Want to learn what else the new bill affects and how the taxes will be spent? Check out the inforgraphs we found below:

Sources:

http://www.gmanetwork.com/news/money/companies/637816/doing-business-easier-for-small-entrepreneurs-with-train-angara/story/

https://www.rappler.com/business/190004-askthetaxwhiz-small-businesses-benefit-tax-reform

http://www.philstar.com/business/2017/12/21/1770239/explainer-how-dutertes-new-tax-law-can-affect-you (inforgraph images)

http://cnnphilippines.com/news/2017/12/19/rodrigo-duterte-tax-reform-2018-budget-sign.html